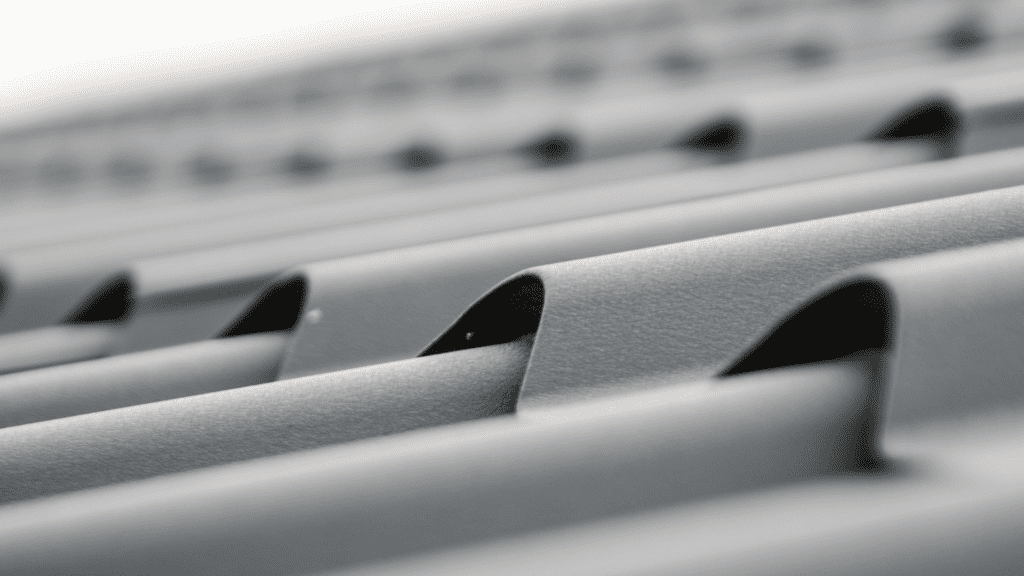

A roof’s replacement or repairs can be expensive. No matter how well-built, a roof eventually weakens and becomes more susceptible to damage, even though it is designed to withstand various weather conditions, including sun, wind, cold temperatures, hail, rain, and more.

If roof damage results from a covered risk, insurance companies usually cover it. However, insurance companies can be reluctant to cover an older roof completely and might even demand an assessment to ensure it is sound to lower the risk of taking on a major damage claim.

The insurance company may refuse coverage if the roof is ancient or improperly maintained. Alternatively, depending on the age and condition of the roof, the carrier may choose to offer real cash value insurance, which only pays for a part of a claim.

Types of Homeowners Insurance Policies

1. HO-1 and HO-2 Policies: Basic policies usually cover specific perils such as fire, theft, and weather-related damages.

2. HO-3 Policy: The most common policy, offering broader coverage for the home’s structure, excluding specific perils outlined in the policy.

3. HO-5 Policy: A comprehensive policy that covers most perils unless explicitly excluded.

Types of roof damage

Regarding house insurance, roof damage can be classified as either wear and tear or damage from a covered loss. For instance, the insurance company will typically step in to pay for the repair or replacement of your roof up to your coverage limits if it has a leak or damage from covered perils like rain, hail, snowstorms, falling tree branches, wind, or fire (assuming your policy has no exclusions regarding your roof).

An insurance carrier is unlikely to pay for repairing damage or replacing a roof if the leak is unrelated to a covered risk because of factors like structural collapse, poor maintenance, or an aging roof. Continuous roof care is essential to keep your roof in good condition and utilize the financial security provided by your homeowner’s insurance.

Speak with your insurance agent if you have any questions about the coverage and exclusions of your home insurance policy to avoid being caught off guard.

Determining Coverage for Roofing Repairs

- Review Policy Details: To understand certain coverage details, it is essential that you carefully review the documentation that accompanies your insurance policy. Take note of any deductibles, exclusions, and the scope of coverage for damage to the roof. Comprehending these particulars facilitates evaluating the extent of insurance coverage for prospective roof maintenance.

- Contact Your Insurance Provider: It’s important to speak with your insurance provider if you have any questions concerning your coverage. Ask about coverage for roof damages and allow them to answer any particular questions you may have about your policy’s coverage.

- Document Damage Evidence: Keeping a record of the circumstances is essential for the insurance claim procedure for roof damage. Take crisp pictures or videos demonstrating the damage amount to bolster your insurance claim.

- Obtain Repair Estimates: Getting quotes from certified roofers will help you when you submit an insurance claim. When requesting reimbursement for the roof repairs, these estimates are essential records.

Tips for Maximizing Coverage

- Regular Maintenance and Inspections: Preventing possible problems with regular inspections and maintenance helps to guarantee that your roof is in good shape.

- Understand Policy Updates: Keep yourself updated on any modifications to your policy that may affect your coverage for damage to your roof.

- Timely Claims Reporting: To speed up the claims procedure and achieve a quicker resolution, report any damages as soon as possible.

- Roof Age and Material: Certain materials or older roofs may impact the amount of reimbursement or eligibility for coverage.

- Regional Factors: Coverage concerns may be impacted by geographic areas vulnerable to extreme weather events like hurricanes or hailstorms.

- Roof Replacement Policy Riders: You can get more protection by looking into additional policies for roof replacements or improved damage coverage.

- Home Warranty Coverage: It can be helpful to look into alternatives for a home warranty covering roof repairs not covered by regular insurance.

Filing a Claim for Roof Damage

Assessing Damage

In the event of roof damage, documenting the extent of the damage with photographs and detailed notes is crucial for filing a claim.

Contacting Your Insurance Provider

Promptly notify your insurance company about the damage. They will guide you through the claim process, which often involves an inspection by a claims adjuster.

Conclusion

Comprehending the scope of coverage for roofing under your homeowners’ insurance is essential for financial stability and readiness. Always review the specifics of your policy, especially the exclusions and restrictions, and, if necessary, look into getting more coverage to protect your house properly.

If you find this article helpful or have any suggestions, feel free to reach us!